What Is the Difference Between a Trust and a Will in Ghana? A Guide to Smart Estate Planning

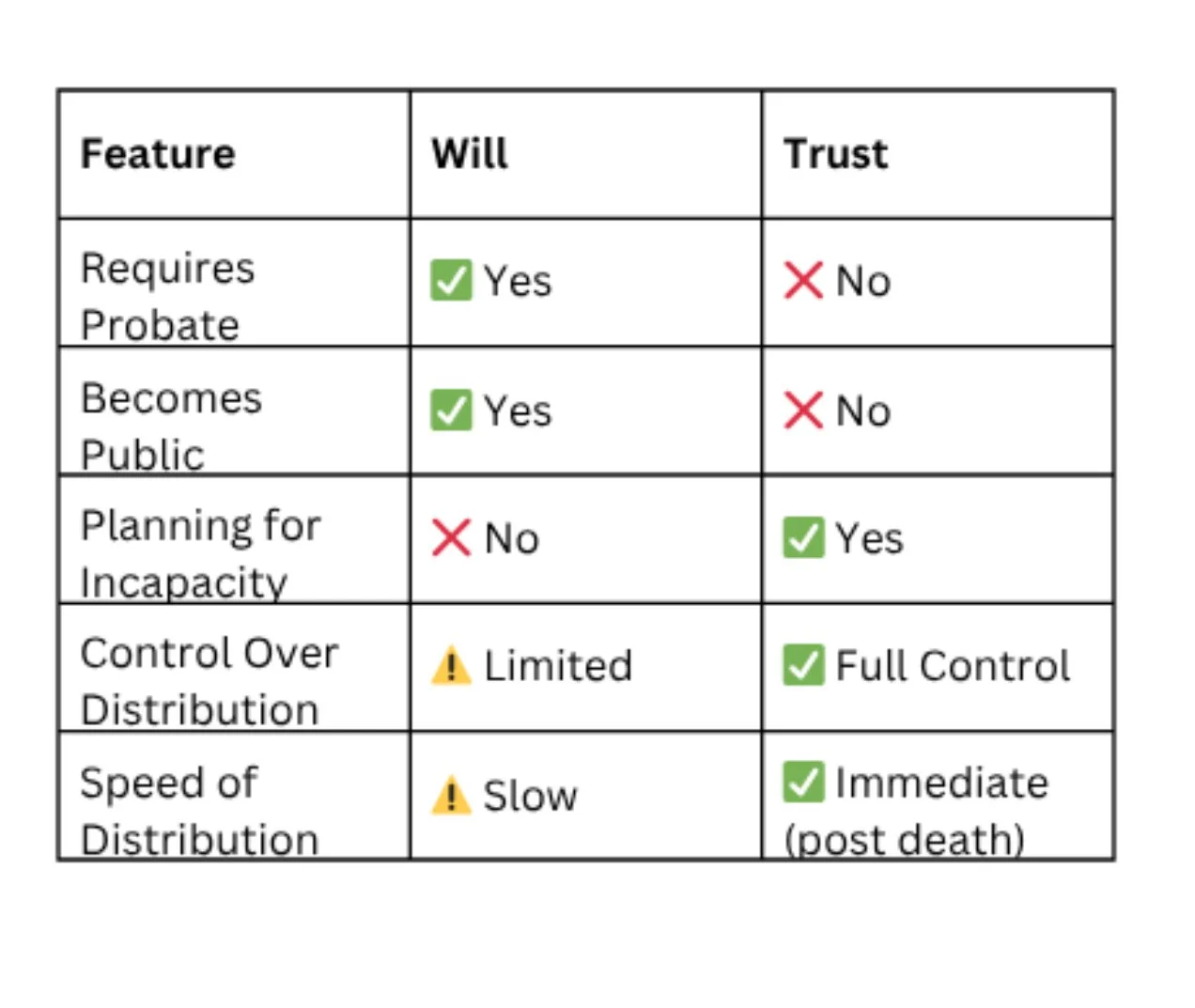

When planning your estate, two tools often come to mind: wills and trusts. While both are legally recognized means of passing on your assets, they operate very differently, especially when it comes to cost, privacy, flexibility, and control.

At Scribe Advisory & Consulting, we often work with individuals, families, and entrepreneurs across Africa who want to protect their assets, avoid legal complications, and ensure a smooth transition of wealth. In this article, we explore why a trust may be a better option than a will in modern times, particularly in Ghana and similar jurisdictions.

What’s the Difference Between a Will and a Trust?

A will is a legal document that outlines how your assets should be distributed after your death. It can also name guardians for minor children and detail your final wishes. However, wills must go through probate, a court-supervised process that can be time-consuming, expensive, and emotionally taxing for your loved ones.

A revocable living trust, on the other hand, is a legal arrangement that allows you to transfer your assets into a trust during your lifetime. You can act or appoint another person or corporate body as the trustee and name a beneficiary, with a successor trustee stepping in upon your incapacity or death to manage and distribute the trust’s assets according to your instructions, without going through probate.

Why Many Ghanaians Are Now Considering Trusts

Avoiding the Probate Process in Ghana

Probate in Ghana can be lengthy, costly, and complicated. According to Order 66(1) of CI 47, probate applications can be filed in the High Court, Circuit Court, or District Court, depending on the estate’s value. The process includes validating the will, settling debts, and resolving any challenges.

In practice, probate can be delayed by:

• Legal challenges to the will’s validity

• Family disputes over asset distribution

• Claims from creditors

• Filing of caveats, which can legally pause the probate process (Order 66 r 11(1), CI 47)

Until a grant of probate or letters of administration is issued, any interference with the estate is considered unlawful intermeddling, a criminal offence under Ghanaian law.

A trust eliminates the need for probate entirely, ensuring your beneficiaries receive assets quickly and without court intervention.

Common Challenges with Probate in Ghana

If you're relying solely on a will, be aware of the following issues:

• Contested wills: Family members or other parties may dispute the will’s validity or allege undue influence.

• Ambiguities in distribution: Poorly drafted wills can lead to interpretation disputes.

• Delays: Probate can take several months or even years.

• Liabilities: Creditors may bring claims that reduce the estate’s value.

A trust helps bypass these issues, providing a simpler, cleaner transition.

Key Benefits of Setting Up a Trust in Ghana

🔒 1. Privacy

Wills become public record after death. This means anyone can access the details of your estate. Trusts, however, remain private even after your death. This can be crucial if:

• You are a high-profile individual

• You have sensitive asset distributions

• You want to maintain discretion

🧠 2. Incapacity Planning

If you become incapacitated due to illness or accident, a will doesn’t help until after death. A revocable living trust lets you appoint a successor trustee to manage your affairs if you’re unable to without court intervention.

🎯 3. Greater Control & Flexibility

With a trust, you can:

• Set conditions for distribution (e.g., upon turning 25, graduating, or buying a home)

• Design staggered payments

• Protect against mismanagement or misuse

👪 4. Protection for Vulnerable Beneficiaries

If you have children, dependents with disabilities, or beneficiaries who struggle with financial discipline, a trust allows you to:

• Appoint a trustee to manage their inheritance

• Prevent lump sum payouts

• Safeguard long-term well-being

Trust vs. Will: Which is Right for You?

At Scribe Advisory & Consulting, we specialize in estate planning, governance, and legal structuring for individuals and families across Africa. Whether you’re looking to set up a trust, draft a will, or understand your options, we’re here to guide you with clarity and care.

Book a consultation today and let us help you protect your legacy confidently.